Implied equity market

volatility (as measured by VIX) is determined by a reflexive loop between the

derivative and underlying markets based on future estimate of realized

volatility of the underlying (S&P500 Index) + characteristic movements of

the underlying. There are of course many more factors that affect the VIX--such

as skew of implied volatility curve, day of the week, holidays in a given

month, upcoming events that could impact the market--just to name a few.

Unlike determining the

direction of stock prices, forecasting volatility can be a matter with which

investors are unfamiliar. While this

may sound like a complex concept, it can be easily broken down into three parts.

I. Forecasting Market Volatility (VIX)

II. Understanding VIX Futures Related ETNs (VXX)

III. Forecasting VXX Prices

I. Forecasting Market

Volatility (VIX)

In a nutshell, an

investor could get a good sense of whether equity market volatility or VIX is

cheap or expensive based on following the analysis of 1) Various GARCH model

estimates and 2) Median Curve of VIX dependent on (SPY)

prices in relation to its various moving averages.

The first step

involves looking at estimates of future realized volatility. V-Lab

is an excellent website to get up-to-date estimates of the future realized

volatility of the S&P500 Index based on various GARCH models. (Wikipedia is an excellent resource to

understand the technical definitions of GARCH

Models). In V-Lab, click on SPX, and

several analyses of S&P500 Index will show. I like to look at EGARCH return series (just a personal

preference). The graph below is from

V-Lab and shows EGARCH volatility prediction for future realized volatility of

the S&P500 Index. As of August 23,

2012, the value for 1-month prediction was 15.13%.

One should then

compare this number to the At-The-Money (ATM) implied volatility level of

S&P500 Index options, depending on number of days to go before

expiration. Since we have two weeks

remaining to August expiration, we should average the implied volatility levels

of SPY August & September 139/140 strike options, which are

At-the-money. ATM implied volatility

numbers can be found in Morningstar's

website under "Options" tab for SPY and the average currently stands

at 14.4%.

Usually, volatility

values from EGARCH model are a couple of points lower than implied volatility

values of ATM options. The reason is

that investors would rather buy options than sell them, given a 50/50 outcome

of a gain vs. a loss, because the potential payout of unlimited gain and

limited risk is far more attractive.

Furthermore, if the EGARCH model estimate of 15.13% proves to be

accurate, options theory tells us that one could purchase an ATM options

straddle at 14.4% volatility level and dynamically scalp deltas at 15.13%

volatility level for a small, but riskless profit. Commissions, slippage and other costs could make this trade less

attractive, but these costs are very low for market makers. To market makers, the current situation

would be like owning almost free options, and almost free options are always a

good to own. Based on realized

(future estimate) volatility analysis, I would say that current implied

volatility levels are undervalued.

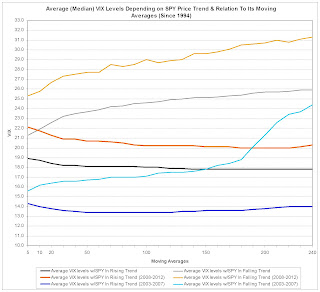

The second step is to

look at median values of VIX dependent on where SPY prices are relative to its

various moving averages because changes in VIX are dependent not only in the

volatility of SPY prices, but also in how comfortable investors are about the

market. The chart below shows analysis

that I conducted. Median values

represent 50/50 probability of VIX being above or below a specified level based

on historical data.

For example, since

1994, shown in black & grey, when SPY prices were in an up trend and above

its moving averages, the median VIX levels were around 18%. On the other hand, when SPY prices were in

correction and below its moving averages, the median levels were between

22-26%. I would say that the 20-day,

50-day, & 200-day moving averages are most widely followed.

I also included two

other plots showing "distinct" periods when VIX remained high or low

for extended periods of time. Between

2003-2007, shown in blue & cyan, VIX levels remained low. The median VIX level when SPY prices were

above its moving averages was around 13.6%, while when SPY prices were below

its moving averages, median VIX levels ranged from 16.4-24.4%. On the other hand, between 2008-2011, shown

in red & orange, VIX levels remained high. The median VIX levels during

this period were 20.5% and 26-31%, respectively. I believe the long-term median VIX values in black & grey are

befitting to the recent market environment in 2012

If we look at the

current graph of SPY below, SPY closed on August 3, 2012 at 139.35 and remains

above all moving averages and is moving within a clearly defined uptrend. Based on median VIX value analysis, I would

think VIX levels around 17 would be considered “fair value”. VIX closed at 15.64 on August 3rd,

therefore, probability analysis also confirms that current VIX level is

undervalued.

Finally, the third

chart below shows the graph of VIX relative to my custom built, Fair Volatility

Estimate (FVE) Indicator. FVE takes

into calculation 1) the future realized volatility estimate and 2)

characteristic movements of SPY, as well as other factors, in a visually simple

indicator. According to FVE, VIX remains below FVE’s value of 18.9 and thus

visually illustrates the conclusions we drew from the two separate analyses

above that VIX remains “undervalued”.

Now that we have

walked through this process and determined that VIX is indeed undervalued based

on 1) estimate of future realized volatility and 2) historical probability, how

can we make money off of this analysis?

II. Understanding VIX

Futures Related ETNs (VXX)

Unfortunately, VIX is

not an instrument one could realistically trade. There are instruments that have been created based on VIX

futures, but these instruments have complex idiosyncrasies of their own. Let us look at iPath S&P500 VIX

short-Term Futures ETN (VXX) because it is by far the most popular VIX-related

instrument available to retail investors.

VXX is designed to

replicate, net of expenses, the S&P 500 VIX Short-Term Futures Total Return

Index. Basically, what this means is

that VXX holds in its portfolio a combination of front month and second month

VIX futures positions in order to maintain a constant 1-month forward VIX

futures positions. For example, at the start of a new expiration month

(say August), VXX would be holding nearly 100% August VIX futures in its

portfolio. With two weeks to go to expiration, VXX would be holding

roughly 50% August VIX futures and 50% September VIX futures. As August

expiration approaches, VXX would be holding closer to 100% September VIX

futures position. The daily performance of VXX would be similar to the

weighted average daily price changes of the first two monthly VIX futures

positions.

Many investors who

thought VXX was a good instrument to buy and hold or use it as a hedge against

rising volatility have suffered considerable losses. Mainly, this is

because of the cost of carry as a result of contango in the very futures

instruments that VXX holds in its portfolio.

Contango means that each subsequent expiration month of VIX futures

prices are trading higher than the closer month’s VIX futures prices and the

spot VIX overall (upward sloping curve).

The effects of contango on VXX can be seen visually in the graph below. The graph shows the average premium the

front month and second month VIX futures trades over spot VIX over time, along

with cumulative average cost per month that puts significant downward pressure

on VXX prices.

When in contango, VIX

front month futures (in blue) on average start off 10% higher than the spot VIX

with 21 trading days to go before expiration.

As expiration approaches, this premium goes to zero. Likewise, VIX second month futures (in red)

on average start off 15% higher than spot VIX.

The premium on this goes down as well as time passes. The net effect (shown in Green) is that VIX

futures contango has reduced on average the price of VXX by 6.5% per month!

Remember,

when VIX rises above 25 level, VIX futures usually goes into

backwardation. Backwardation can be

understood as the opposite phenomenon as contango. Backwardation begins

to happen when Spot VIX is higher than front month VIX futures, and complete backwardation

occurs (very rarely) when VIX futures prices of each subsequent expiration

month is lower than the price of VIX futures in expiration months that are

closer (downward sloping curve). When VIX futures are in backwardation,

VXX prices would theoretically rise as time passes, even if spot VIX were to

remain constant.

To

test the accuracy of how contango affects VXX prices, I plotted VXX prices from

the beginning of 2012 and compared this to the theoretical VXX price taking

into account the daily price change of VIX less the average daily cost burden

from VIX futures contango. As you can see over time, theoretical VXX

prices mirrored actual VXX prices as shown in the graph below.

As a rule of thumb, from the beginning of a new

expiration month, the average daily cost from contango has been 0.25% for each

trading day. With 5 days to go before

expiration, however, the cost has jumped to 0.45% for each trading day. More appropriate way of looking at this is

on a weekly basis. With 4 weeks to go before expiration, the effects of

contango has eaten away on average 1.25% from the price of VXX each passing

week, but during the final week 2.25% has been chomped off!

III. Forecasting VXX

Prices

Now that we have

understood what VXX is and how contango affects the price of VXX, let us

revisit our VIX forecast from above and translate this into a forecast for VXX

prices. Let us assume that fair value

of VIX is around 18 level, and VIX will rise to 18 sometime in the next two

weeks before August VIX Expiration. As

long as SPY prices continue to trade within its rising channel, VIX is expected

to fluctuate from 16-19 level for the next two weeks as well. VIX August futures price closed at 17.20,

and VIX September futures price closed at 19.40 on August 3rd.

If VIX were to rise to

18 level one week from now (15.1% higher from 15.64 level), VIX August &

September Futures prices could be expected to trade around 18.85 & 20.25,

respectively, according to the average premiums VIX futures trade over spot VIX

when in contango with 7 trading days to go before expiration. Calculating for the weighted average rise in

VXX’s portfolio of VIX August & September futures positions, VXX is then

expected to rise 6.9% to 13.0 from August 3rd closing price of

12.16. Following the same methodology,

if VIX were to rise to 18 level right before August expiration (slightly over

two weeks from now), VXX is expected to be trading around 12.55, or just 3.0%

higher than August 3rd closing price! Finally, if VIX were to move within 16-19 range until VIX August

expiration, VXX prices could trade between 11.15 to 13.70. Please consider how different VXX moves

in comparison to spot VIX and understand how important it is to not only to

forecast VIX but to carry out analysis to forecast VXX when one wants to trade

volatility instruments.

A

superior risk adjusted trading strategy to execute based on the above forecasts

would be to buy August VIX futures while simultaneously selling September VIX

futures as a spread. The logic behind

this trade is that the front month futures would rise a greater percentage than

the second month futures if VIX were to rise as expected, but at current price

levels, the spread is not expected to lose much if VIX does not rise. Another strategy would be to sell the VXX

August monthly 13/14 call spread and sell the VXX 12 puts for close to 0.70

credit, which should generate a profit if spot VIX moves within our forecast,

but should VXX fall close to 11 level, it would be worth owning VXX outright

for a short-time to recover any losses from this options spread.

By:

Steven Lee

Disclosure: I am slightly long VXX and because VXX is an

instrument to trade, I could exit out of this position in the next 72 hours.