My FVE model calculates "fair value" of VIX based on several assumptions:

1) After 2008 market crash, realized volatility leads implied volatility

(estimated 70% of time)

2) Derivatives market are zero-sum games, thus you would often see

forced liquidation of losing bets (sometimes large), adding to more

frequent over/under valued situations

3) Volatility, although mean-reverting, exhibits strong trends.

3a) Many market makers do not utilize an "absolute value' model but rather

"relative value", or they piggy back off of whatever bid/ask prices are,

thus would add fuel to volatility moving from one equilibrium to

another.

4) Implied Volatility is a reflexive function of realized volatility of the underlying + statistical relationships

on supply & demand of options (as reflected in implied volatility or

VIX) based on characteristics movement of the underlying.

4a) VIX in general is inversely correlated to S&P500 index direction

4b) The more and faster investors are losing money, the more they would seek out protection

4c) I believe whether the underlying is in a trend or a range affects supply and demand for options.

FVE indicator and simple trading rules takes into account these assumptions in a

crude (yet seemingly very effective and relatively simple) model. I am not a programmer or a mathematician, so anyone with

knowledge and skills in these areas could probably

come up with a superior volatility (VIX) model. I hope my

contribution would be my insight into the market volatility.

I do believe in a

top-down (qualitative-->quantitative) approach, where one would

detail assumptions about a market (current environment), create and

apply effective algorithms, then test the algorithms in their

effectiveness. I guess the other approach would be bottom-up through

data mining.

I would love to learn about assumptions made in other models. Thanks.

Disclaimer

Disclaimer: The information found on this site is meant for educational and informational purposes only. Nothing on this site should be construed as a recommendation or solicitation to buy or sell derivatives or securities or to trade any particular strategy. Trading of derivatives or securities has large potential risk and you must be aware of and accept all the risks. Past performance of any trading system or methodology is not necessarily indicative of future results. No representation is being made that any account will or is likely to achieve performance results similar to those discussed on this website. Hypothetical or simulated performance results have certain limitations and do not represent actual trading.

Monday, June 25, 2012

Sunday, June 24, 2012

Probability Now Favors Being Long Volatility

Since the last post, FVE has been rising and as of June 23, 2012 close, FVE's value stood at 21.57. VIX did fluctuate quite a bit last week, moving from undervalued to fair-valued, back to being undervalued and closed the week at 18.11.

Prior to Greek elections, VIX was overvalued and VIX futures even more so. After the elections, with the outcome pointing to more status quo (Greece staying in the Eurozone for the time being), "fear" has subsided. Yet, "worries and concerns" about the weakening global economy and unresolved problems in Europe remain in the markets. EU Summit is scheduled for Thursday and Friday of this week and market expectations (and perhaps patience) are high (thin) for the announcement of some concrete plans and actions to tackle all the problems Europe faces.

For S&P500 Index to sustain its short-term rise, some good news would have to come out. Unless we get good news from Europe or good economic data out of Durable Goods Orders, Jobless Claims, etc., the probable scenario for this week is VIX creeping back up to around the 20 level ahead of the Europe Summit and release of economic reports. As for VXX, however, the steep contango in VIX futures would continue to put downward pressure on VXX prices. Net-net, VXX would probably trade between 16-18 level even though a greater rise in percentage terms in VIX is likely.

Prior to Greek elections, VIX was overvalued and VIX futures even more so. After the elections, with the outcome pointing to more status quo (Greece staying in the Eurozone for the time being), "fear" has subsided. Yet, "worries and concerns" about the weakening global economy and unresolved problems in Europe remain in the markets. EU Summit is scheduled for Thursday and Friday of this week and market expectations (and perhaps patience) are high (thin) for the announcement of some concrete plans and actions to tackle all the problems Europe faces.

For S&P500 Index to sustain its short-term rise, some good news would have to come out. Unless we get good news from Europe or good economic data out of Durable Goods Orders, Jobless Claims, etc., the probable scenario for this week is VIX creeping back up to around the 20 level ahead of the Europe Summit and release of economic reports. As for VXX, however, the steep contango in VIX futures would continue to put downward pressure on VXX prices. Net-net, VXX would probably trade between 16-18 level even though a greater rise in percentage terms in VIX is likely.

Tuesday, June 19, 2012

VIX Is Now Undervalued

According to my FVE model, VIX is now undervalued. As of 9:20am CST, June 19, 2012, FVE's value is 19.5 while VIX is 17.7. Granted tomorrow morning is VIX expiration--VIX tends to be very volatile and less reliable closer to expiration because small changes in bid/ask spread of out-of-the-money S&P500 Index options can change the value of VIX significantly. So VIX could easily rise to 19 on purely technical reasons without much implication to the markets. Having explained that, VIX is still undervalued.

Because VIX is not a tradeable instrument, we need to analyze VIX futures related instruments. VIX July futures is at 21.6. Given that VIX futures usually trades at a premium over VIX, it seems now fairly valued to slightly "undervalued with one month to go before its expiration. Furthermore, VIX August futures is at 23.6, which means that VIX futures contango is steep. This steep contango, were it to persist, would continue to put considerable pressure on price of VIX futures related instruments such as VXX. The reason is that VXX carries daily rolling positions of first two front month VIX futures. VXX would be selling some of cheaper VIX July futures to buy more expensive VIX August futures causing it to lose some of its value each and every day as long as contango persists. Because of this, VXX may not rise even if VIX does.

Some form of action by central banks to support the financial markets seems to be fully reflected in the markets now, and if the US equity market remains stable than prices of VIX futures related instruments like VXX could continue to fall. Last week, my FVE model indicated that VIX was considerably overvalued and VIX futures even more so ahead of the Greek elections. I suggested shorting volatility in my post "What Happens To VIX After Greek Vote?". Now, with VIX and VIX futures related instruments having plunged, the risk/reward profile appears no longer to be in favor of staying short VIX futures related instruments.

Because VIX is not a tradeable instrument, we need to analyze VIX futures related instruments. VIX July futures is at 21.6. Given that VIX futures usually trades at a premium over VIX, it seems now fairly valued to slightly "undervalued with one month to go before its expiration. Furthermore, VIX August futures is at 23.6, which means that VIX futures contango is steep. This steep contango, were it to persist, would continue to put considerable pressure on price of VIX futures related instruments such as VXX. The reason is that VXX carries daily rolling positions of first two front month VIX futures. VXX would be selling some of cheaper VIX July futures to buy more expensive VIX August futures causing it to lose some of its value each and every day as long as contango persists. Because of this, VXX may not rise even if VIX does.

Some form of action by central banks to support the financial markets seems to be fully reflected in the markets now, and if the US equity market remains stable than prices of VIX futures related instruments like VXX could continue to fall. Last week, my FVE model indicated that VIX was considerably overvalued and VIX futures even more so ahead of the Greek elections. I suggested shorting volatility in my post "What Happens To VIX After Greek Vote?". Now, with VIX and VIX futures related instruments having plunged, the risk/reward profile appears no longer to be in favor of staying short VIX futures related instruments.

Wednesday, June 13, 2012

What Happens To VIX After Greek Vote?

- Ahead of the Greek Vote this weekend, market volatility as measured by VIX is likely to rise or remain elevated. Usually ahead of possible market moving events, implied volatility rises due to investors buying options to position themselves for a big move after the outcome. Historically, however, it has been profitable to sell volatility into such Events.

- Last week, VIX declined from extremely overvalued state as measured by my FVE Indicator back down to fair value. With the rise in VIX this week, VIX is once again moving into overvalued territory.

- Last week, VIX declined from extremely overvalued state as measured by my FVE Indicator back down to fair value. With the rise in VIX this week, VIX is once again moving into overvalued territory.

- If we look at history, VIX rarely stays above the 30 level, even during market corrections. In fact, right before Lehman was allowed to fail, VIX was at 20 level despite a market correction that had been ongoing for 10 months--granted VIX was highly undervalued at that moment in time in August 2008. The second chart shows that FVE was indicating "fair value" of VIX to be 25 level in August 2008.

- What is interesting about the situation now is that FVE is indicating VIX to be overvalued as seen in the graphs above. In each of the three instances of extreme VIX spikes, FVE was indicating that VIX was undervalued or at least properly valued prior to VIX soaring past the 30 level. Each of these instances were also accompanied by a market shock--events that the market was not expecting. Lehman failure in 2008, Flash Crash in May 2010, and the second bailout of Greece in August 2011 and its implications for effects of contagion to larger European economies.

- So the answer to the question "What happens to VIX after Greek Vote?" really depends not so much on the outcome, but what is already being discounted in the equity market. Would Greece voting to leave the Eurozone really be a negative for the markets? Were not the markets really concerned about contagion to Spain and Italy? Has not Spain already succumbed to brutal market pressure and raised an unofficial white flag? Are not forces already in the midst of trying to attack Italy?

- The first condition that puzzles me is why the S&P500 Index remains above its 200-day moving average despite all the negative developments ongoing in global markets and the global economy. The second puzzling condition is why my FVE indicator has been consistently below VIX for the past month indicating that VIX is overvalued (after it had been above VIX the prior two months indicating that VIX was undervalued). The logical conclusion to this is that (barring any unexpected shocks like any other Euro members choosing to leave besides Greece) even if the US market correction continues, sudden plunges in the S&P500 Index is not likely and thus sudden spikes in VIX is also not likely.

- Perhaps a good trading strategy would be to buy put spreads or sell call spreads on VXX or July VIX options (since July VIX futures are trading at a premium to the VIX) ahead of the weekend. Always control your risks.

- Last week, VIX declined from extremely overvalued state as measured by my FVE Indicator back down to fair value. With the rise in VIX this week, VIX is once again moving into overvalued territory.

- Last week, VIX declined from extremely overvalued state as measured by my FVE Indicator back down to fair value. With the rise in VIX this week, VIX is once again moving into overvalued territory.- If we look at history, VIX rarely stays above the 30 level, even during market corrections. In fact, right before Lehman was allowed to fail, VIX was at 20 level despite a market correction that had been ongoing for 10 months--granted VIX was highly undervalued at that moment in time in August 2008. The second chart shows that FVE was indicating "fair value" of VIX to be 25 level in August 2008.

- What is interesting about the situation now is that FVE is indicating VIX to be overvalued as seen in the graphs above. In each of the three instances of extreme VIX spikes, FVE was indicating that VIX was undervalued or at least properly valued prior to VIX soaring past the 30 level. Each of these instances were also accompanied by a market shock--events that the market was not expecting. Lehman failure in 2008, Flash Crash in May 2010, and the second bailout of Greece in August 2011 and its implications for effects of contagion to larger European economies.

- So the answer to the question "What happens to VIX after Greek Vote?" really depends not so much on the outcome, but what is already being discounted in the equity market. Would Greece voting to leave the Eurozone really be a negative for the markets? Were not the markets really concerned about contagion to Spain and Italy? Has not Spain already succumbed to brutal market pressure and raised an unofficial white flag? Are not forces already in the midst of trying to attack Italy?

- The first condition that puzzles me is why the S&P500 Index remains above its 200-day moving average despite all the negative developments ongoing in global markets and the global economy. The second puzzling condition is why my FVE indicator has been consistently below VIX for the past month indicating that VIX is overvalued (after it had been above VIX the prior two months indicating that VIX was undervalued). The logical conclusion to this is that (barring any unexpected shocks like any other Euro members choosing to leave besides Greece) even if the US market correction continues, sudden plunges in the S&P500 Index is not likely and thus sudden spikes in VIX is also not likely.

- Perhaps a good trading strategy would be to buy put spreads or sell call spreads on VXX or July VIX options (since July VIX futures are trading at a premium to the VIX) ahead of the weekend. Always control your risks.

Friday, June 8, 2012

VIX Back To Fair Value

- A strong rebound in SPY this week resulted in a plunge in VIX from 27 level to under 22. VIX is now "fair value" according to my FVE model. This is my shortest post because I see no compelling reason to go long or short volatility at this level.

Sunday, June 3, 2012

Is VIX at Appropriate Level?

- On Friday, June 1, 2012, S&P500 Index closed below its 200-day Simple Moving Average. Why is this significant? Many investors look at the 200-day moving average as the "unofficial" gauge to declare whether the US stock market is in a "Bull" or "Bear" market. Many technical analysts also believe 200-day moving average serves as a strong support or resistance level.

-One facet of the equity markets where the significance of whether the S&P500 Index is above or below its 200-day moving average is in Volatility measures or specifically VIX. I ran some analysis on SPDR S&P500 (SPY) ETF and VIX to determine the statistical probability of VIX levels dependent on whether SPY prices are higher or lower than its 200-day moving average. The results are shown on the first graph.

-One facet of the equity markets where the significance of whether the S&P500 Index is above or below its 200-day moving average is in Volatility measures or specifically VIX. I ran some analysis on SPDR S&P500 (SPY) ETF and VIX to determine the statistical probability of VIX levels dependent on whether SPY prices are higher or lower than its 200-day moving average. The results are shown on the first graph.

- The solid blue-line represents on any given trading day, the probability that VIX would be higher than a specific level when SPY is greater than its 200-day MA since January of 1994. The blue-dash line represents the same figures but the period since January of 2008. The reason I chose to look at the time period since January 2008 is because the financial crisis of 2008 and the current crisis affecting Europe (and the rest of the world) are considered to be part of the same phenomenon. The red line and red-dash line represent probability of VIX being higher than a specified level, except this time the condition being SPY below its 200-day MA.

- The solid blue-line represents on any given trading day, the probability that VIX would be higher than a specific level when SPY is greater than its 200-day MA since January of 1994. The blue-dash line represents the same figures but the period since January of 2008. The reason I chose to look at the time period since January 2008 is because the financial crisis of 2008 and the current crisis affecting Europe (and the rest of the world) are considered to be part of the same phenomenon. The red line and red-dash line represent probability of VIX being higher than a specified level, except this time the condition being SPY below its 200-day MA.

- The results are not surprising but highly informative. On Friday, June 1, 2012, the value of VIX was at 26.66. According to my analysis, the probability that VIX would be higher than 26 level is only 7.18% when SPY is higher than its 200-day MA but jumps to 48.17% when SPY is below its 200-day MA since 1994. These figures jump even higher when looking at time period since 2008, 9.57% and 64.57%, respectively. If we consider 50/50 probability to determine the appropriate VIX level, then the current VIX level of 26.66 is not too far off from the "appropriate" level calculated to be between 25.5 and 30.3.

- Now, just because in one trading day, SPY penetrated below its 200-day moving average does not make the "appropriate" VIX level jump from 18-20 range when SPY is higher than its 200-day MA to 25.5 to 30.3 range when SPY is below its 200-day MA. Rather, VIX moves in a time-series or trend and its outcome is not binary. However, I do believe that the US equity markets and VIX levels are at a point of inflection. The price trend of SPY in the near-term (few days to a few weeks) could determine whether VIX continues to soar or plunges back down.

- There are other methods to measure the "appropriate" level of VIX. Based on options theory, the theoretical value of options or "appropriate" implied volatility level of options should not be too far off from the estimated value of future, actual or realized volatility level of the underlying instrument. Traditionally, historical volatility has been used as a gauge to estimate future realized volatility. The second chart is a graph from IVolatility.com (http://www.ivolatility.com/) and shows the trend of the IVolatility's calculation of mean implied volatility levels on SPY options (in yellow) compared to the 30-day historical volatility trend of SPY (in blue). According to values from IVolatility.com, the mean Implied Volatility Index was at 23.77% on Friday, June 1, 2012, while 30-day historical volatility level was at 14.42.

- GARCH models are more sophisticated ways of estimating future volatility of the underlying. V-Lab posts updated figures of estimated future realized volatility levels of thousands of underlying instruments and indices (http://vlab.stern.nyu.edu/). According the V-Lab, the 1-month predicted realized volatility of the S&P500 Index is 17.07 (third graph shows the trend of V-Lab's GARCH model estimate), compared to at-the-money implied volatility level of around 20 for S&P500 Index June/July options.

- Based on historical volatility or GARCH model measures, one could conclude that implied volatility levels of SPY or S&P500 Index options are in-line or "appropriate" or even slightly overvalued. If the discrepancy between estimated future volatility and implied volatility levels got too out of line, options traders would buy of sell options to raise or lower the implied volatility levels to profit from what is known as volatility arbitrage.

- Finally, there is another model that I have developed, called "Fair Value Estimate" (FVE) Model. Instead of trying to estimate future realized volatility of SPY or S&P500 Index, FVE calculates the "appropriate" VIX level on any given moment based on price action of SPY. Because FVE Model's focus is on the VIX, it has been an indispensible tool for me to analyze the VIX and price levels of VIX-related instruments, such as VIX futures and VXX.

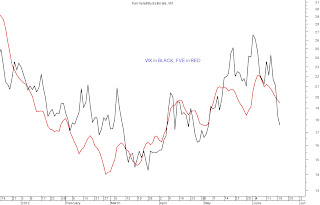

- The fourth graph shows a chart of VIX in comparison to FVE Indicator (in red) since 1993. Currently, the FVE Model is indicating that VIX is overvalued and significantly so. The top indicator, also in red, is a filter showing instances when VIX was spiking up and FVE was 20% lower than VIX since 1993. What is of significance is that each and everytime VIX experienced a significant uptrend, FVE had either led or was concurrent with the rise in VIX. Furthermore, every time VIX was over 20% higher than FVE Indicator's value, VIX reached its top and began dropping within a week period. The exception was in 1998. In August 14, 1998, VIX was 34.75 or 25.5% higher than FVE Indicator's value of 25.87. Instead of dropping, VIX continued rising to a top of 45.74 on October 8, 1998 before ultimately returning to the 20 level. This time period coincided with the Russian Financial Crisis and Fed's bailout of Long-term Capital Management.

- In conclusion, I presented four different methods of analysis on the VIX. Based on the SPY being above or below its 200-day moving average, I presented probabilities that VIX could easily move either above 30 level or back down to below 20 level. That would undoubtedly depend on developments (or lack thereof) coming out of Europe and possible action by central banks. I also presented three different models to calculate the "appropriate" level of VIX. The models are indicating that VIX could be "overvalued" or at best appropriately valued, which is slightly a contrarian view given all the uncertainty surrounding Europe and global economy's health. Regardless of what transpires in the coming days, US markets are at a point of inflection.

-One facet of the equity markets where the significance of whether the S&P500 Index is above or below its 200-day moving average is in Volatility measures or specifically VIX. I ran some analysis on SPDR S&P500 (SPY) ETF and VIX to determine the statistical probability of VIX levels dependent on whether SPY prices are higher or lower than its 200-day moving average. The results are shown on the first graph.

-One facet of the equity markets where the significance of whether the S&P500 Index is above or below its 200-day moving average is in Volatility measures or specifically VIX. I ran some analysis on SPDR S&P500 (SPY) ETF and VIX to determine the statistical probability of VIX levels dependent on whether SPY prices are higher or lower than its 200-day moving average. The results are shown on the first graph. - The solid blue-line represents on any given trading day, the probability that VIX would be higher than a specific level when SPY is greater than its 200-day MA since January of 1994. The blue-dash line represents the same figures but the period since January of 2008. The reason I chose to look at the time period since January 2008 is because the financial crisis of 2008 and the current crisis affecting Europe (and the rest of the world) are considered to be part of the same phenomenon. The red line and red-dash line represent probability of VIX being higher than a specified level, except this time the condition being SPY below its 200-day MA.

- The solid blue-line represents on any given trading day, the probability that VIX would be higher than a specific level when SPY is greater than its 200-day MA since January of 1994. The blue-dash line represents the same figures but the period since January of 2008. The reason I chose to look at the time period since January 2008 is because the financial crisis of 2008 and the current crisis affecting Europe (and the rest of the world) are considered to be part of the same phenomenon. The red line and red-dash line represent probability of VIX being higher than a specified level, except this time the condition being SPY below its 200-day MA.- The results are not surprising but highly informative. On Friday, June 1, 2012, the value of VIX was at 26.66. According to my analysis, the probability that VIX would be higher than 26 level is only 7.18% when SPY is higher than its 200-day MA but jumps to 48.17% when SPY is below its 200-day MA since 1994. These figures jump even higher when looking at time period since 2008, 9.57% and 64.57%, respectively. If we consider 50/50 probability to determine the appropriate VIX level, then the current VIX level of 26.66 is not too far off from the "appropriate" level calculated to be between 25.5 and 30.3.

- Now, just because in one trading day, SPY penetrated below its 200-day moving average does not make the "appropriate" VIX level jump from 18-20 range when SPY is higher than its 200-day MA to 25.5 to 30.3 range when SPY is below its 200-day MA. Rather, VIX moves in a time-series or trend and its outcome is not binary. However, I do believe that the US equity markets and VIX levels are at a point of inflection. The price trend of SPY in the near-term (few days to a few weeks) could determine whether VIX continues to soar or plunges back down.

- There are other methods to measure the "appropriate" level of VIX. Based on options theory, the theoretical value of options or "appropriate" implied volatility level of options should not be too far off from the estimated value of future, actual or realized volatility level of the underlying instrument. Traditionally, historical volatility has been used as a gauge to estimate future realized volatility. The second chart is a graph from IVolatility.com (http://www.ivolatility.com/) and shows the trend of the IVolatility's calculation of mean implied volatility levels on SPY options (in yellow) compared to the 30-day historical volatility trend of SPY (in blue). According to values from IVolatility.com, the mean Implied Volatility Index was at 23.77% on Friday, June 1, 2012, while 30-day historical volatility level was at 14.42.

- GARCH models are more sophisticated ways of estimating future volatility of the underlying. V-Lab posts updated figures of estimated future realized volatility levels of thousands of underlying instruments and indices (http://vlab.stern.nyu.edu/). According the V-Lab, the 1-month predicted realized volatility of the S&P500 Index is 17.07 (third graph shows the trend of V-Lab's GARCH model estimate), compared to at-the-money implied volatility level of around 20 for S&P500 Index June/July options.

- Based on historical volatility or GARCH model measures, one could conclude that implied volatility levels of SPY or S&P500 Index options are in-line or "appropriate" or even slightly overvalued. If the discrepancy between estimated future volatility and implied volatility levels got too out of line, options traders would buy of sell options to raise or lower the implied volatility levels to profit from what is known as volatility arbitrage.

- Finally, there is another model that I have developed, called "Fair Value Estimate" (FVE) Model. Instead of trying to estimate future realized volatility of SPY or S&P500 Index, FVE calculates the "appropriate" VIX level on any given moment based on price action of SPY. Because FVE Model's focus is on the VIX, it has been an indispensible tool for me to analyze the VIX and price levels of VIX-related instruments, such as VIX futures and VXX.

- The fourth graph shows a chart of VIX in comparison to FVE Indicator (in red) since 1993. Currently, the FVE Model is indicating that VIX is overvalued and significantly so. The top indicator, also in red, is a filter showing instances when VIX was spiking up and FVE was 20% lower than VIX since 1993. What is of significance is that each and everytime VIX experienced a significant uptrend, FVE had either led or was concurrent with the rise in VIX. Furthermore, every time VIX was over 20% higher than FVE Indicator's value, VIX reached its top and began dropping within a week period. The exception was in 1998. In August 14, 1998, VIX was 34.75 or 25.5% higher than FVE Indicator's value of 25.87. Instead of dropping, VIX continued rising to a top of 45.74 on October 8, 1998 before ultimately returning to the 20 level. This time period coincided with the Russian Financial Crisis and Fed's bailout of Long-term Capital Management.

- In conclusion, I presented four different methods of analysis on the VIX. Based on the SPY being above or below its 200-day moving average, I presented probabilities that VIX could easily move either above 30 level or back down to below 20 level. That would undoubtedly depend on developments (or lack thereof) coming out of Europe and possible action by central banks. I also presented three different models to calculate the "appropriate" level of VIX. The models are indicating that VIX could be "overvalued" or at best appropriately valued, which is slightly a contrarian view given all the uncertainty surrounding Europe and global economy's health. Regardless of what transpires in the coming days, US markets are at a point of inflection.

Subscribe to:

Posts (Atom)